Decoding Your Insurance Declaration Page: A Comprehensive Guide

On this special occasion, we will be happy to review interesting topics related to Decoding Your Insurance Declaration Page: A Comprehensive Guide. Come on weave interesting information and provide new views to readers.

The insurance declaration page, often called the "dec page," is arguably one of the most important documents in your insurance policy. It’s a summary of your entire coverage, containing key information like your policy number, coverage limits, deductibles, and the insured property or individual. While it might seem like a dense collection of terms and numbers, understanding your dec page is crucial for ensuring you have the right protection and avoiding unpleasant surprises down the line. This comprehensive guide will walk you through each section of a typical insurance declaration page, providing examples and explanations to help you decipher this vital document.

Think of your declaration page as a snapshot of your insurance agreement. It’s a concise overview of what you’re covered for, how much you’re covered for, and what you’ll need to pay out-of-pocket before your insurance kicks in. It’s not the entire policy document, which can be hundreds of pages long, but it acts as a roadmap, highlighting the most critical aspects of your coverage. Keeping your dec page readily accessible is essential, as you’ll need it when filing a claim, renewing your policy, or simply reviewing your coverage needs.

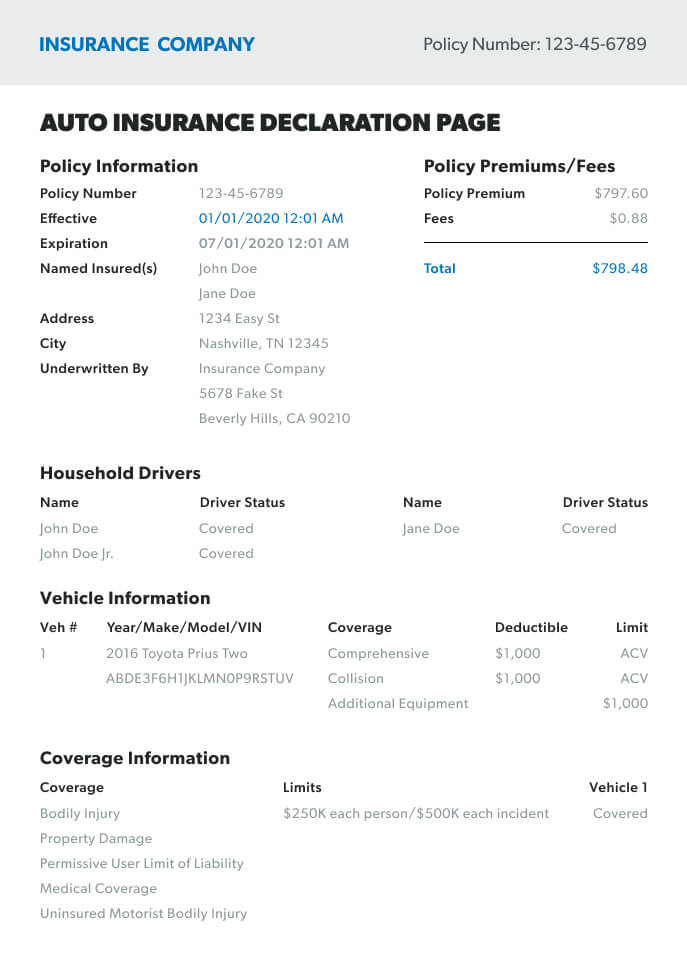

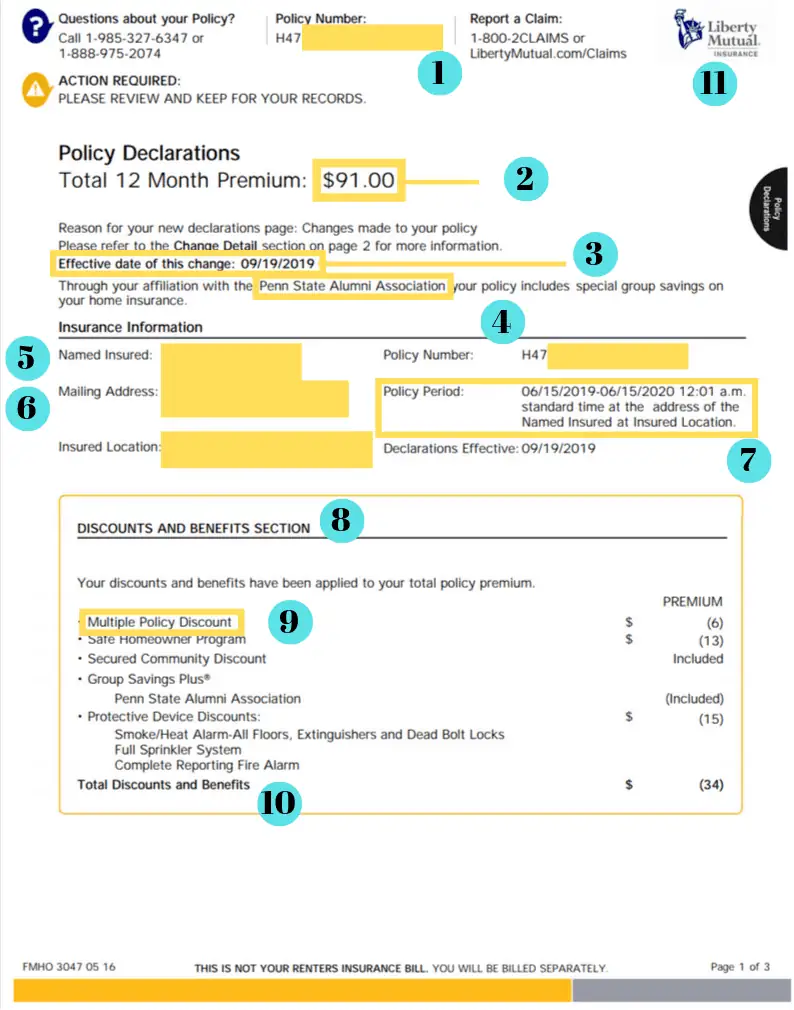

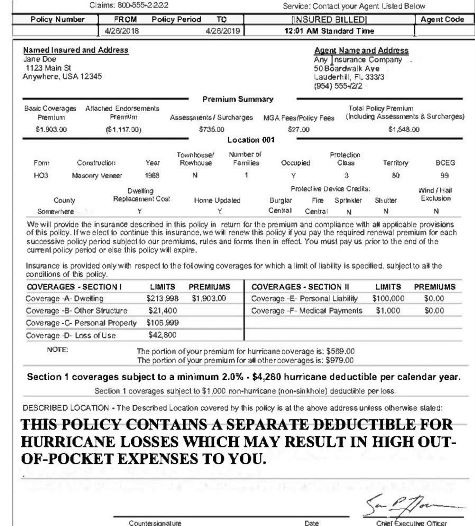

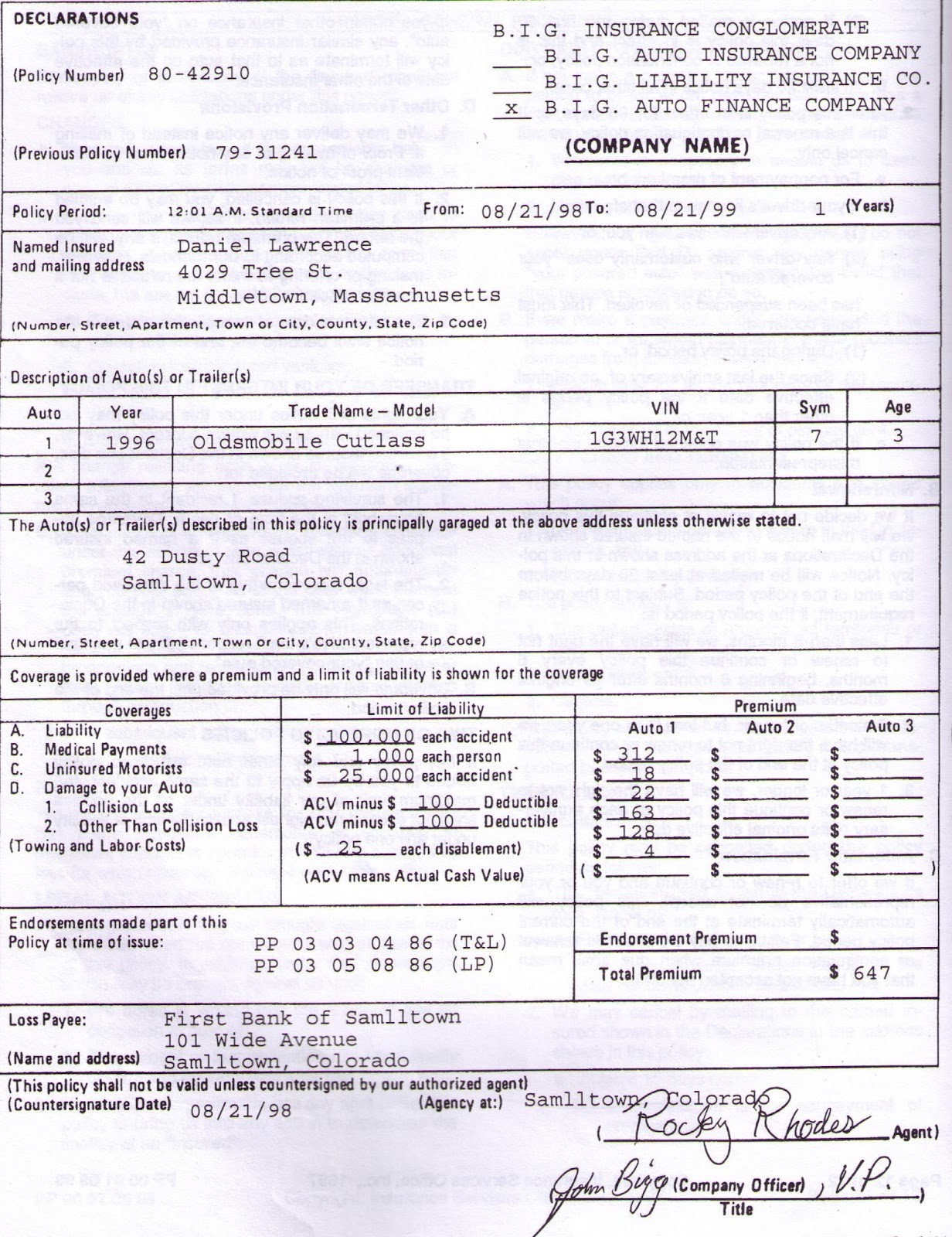

The first section you’ll likely encounter is the Policy Information section. This area typically includes your name and address as the policyholder, the policy number (unique to your specific policy), the policy period (start and end dates of your coverage), and the insurance company’s contact information. The policy number is particularly important as it’s used to identify your policy when communicating with the insurance company or filing a claim. The policy period defines the duration of your coverage, and it’s crucial to ensure your policy is always active to avoid any gaps in protection.

Next, you’ll find the Insured Property or Item section. This section specifically identifies what or who is being insured. For a homeowners insurance policy, it will include the address of the insured property. For auto insurance, it will list the year, make, and model of the insured vehicle, along with its Vehicle Identification Number (VIN). For life insurance, it will identify the insured individual. Accuracy in this section is paramount. Any discrepancies, such as an incorrect address or VIN, could potentially jeopardize your coverage.

The heart of your declaration page lies in the Coverage Summary section. This is where you’ll find the details of your coverage limits and deductibles for various perils. Let’s break this down further with examples. For homeowners insurance, this section will outline coverage for dwelling (the structure of your home), personal property (your belongings), liability (protection if someone is injured on your property), and additional living expenses (temporary housing costs if your home is uninhabitable due to a covered loss). Each coverage will have a specific limit, representing the maximum amount the insurance company will pay for a covered loss.

For instance, your homeowners insurance declaration page might show:

- Dwelling: $300,000

- Personal Property: $150,000

- Liability: $100,000

- Additional Living Expenses: $50,000

These numbers indicate the maximum payout for each category in the event of a covered loss. Understanding these limits is crucial to ensure you have adequate coverage for your needs. If you believe your dwelling coverage is insufficient to rebuild your home, or your personal property coverage doesn’t adequately cover your belongings, you should contact your insurance agent to discuss increasing your limits.

In addition to coverage limits, the Coverage Summary section also specifies your deductibles. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. For example, if you have a $1,000 deductible on your homeowners insurance and experience a covered loss of $5,000, you will pay $1,000, and the insurance company will pay the remaining $4,000. Choosing a higher deductible typically results in lower premiums, but it also means you’ll have to pay more out-of-pocket in the event of a claim.

Auto insurance declaration pages follow a similar structure, outlining coverage for bodily injury liability (if you injure someone in an accident), property damage liability (if you damage someone’s property in an accident), collision (damage to your vehicle caused by a collision), comprehensive (damage to your vehicle caused by events other than a collision, such as theft, vandalism, or weather), and uninsured/underinsured motorist coverage (protection if you’re hit by someone with insufficient or no insurance). Again, each coverage will have specific limits and deductibles.

For example, your auto insurance declaration page might show:

- Bodily Injury Liability: $100,000/$300,000 (per person/per accident)

- Property Damage Liability: $50,000

- Collision Deductible: $500

- Comprehensive Deductible: $250

These numbers indicate the maximum payout for bodily injury and property damage, as well as the amount you’ll pay out-of-pocket for collision and comprehensive claims. Understanding these limits and deductibles is vital for protecting yourself financially in the event of an accident.

The Endorsements section of your declaration page lists any additions or modifications to your standard policy. Endorsements can add coverage for specific items or situations not typically covered, or they can modify existing coverage. For example, you might have an endorsement for earthquake coverage on your homeowners insurance policy, or an endorsement to cover custom equipment on your vehicle. Each endorsement will have a brief description of the coverage it provides.

Another important section is the Premium section. This section outlines the total premium you pay for your insurance policy, as well as the payment schedule. It may also break down the premium into different components, such as the premium for each coverage or endorsement. Reviewing this section ensures you understand the cost of your insurance and how it’s being calculated.

The Discounts section lists any discounts you’re receiving on your insurance policy. Common discounts include multi-policy discounts (for bundling multiple insurance policies with the same company), safe driver discounts (for maintaining a clean driving record), and home security system discounts. Ensuring you’re receiving all the discounts you’re eligible for can significantly lower your insurance premiums.

Finally, the declaration page may include a Notices section, which contains important information from the insurance company, such as changes to your policy, reminders about upcoming renewals, or contact information for claims and customer service. It’s essential to read this section carefully to stay informed about your insurance policy.

In conclusion, understanding your insurance declaration page is crucial for ensuring you have the right coverage and avoiding unpleasant surprises. By carefully reviewing each section, including the policy information, insured property, coverage summary, endorsements, premium, discounts, and notices, you can gain a clear understanding of your insurance protection. If you have any questions or concerns about your declaration page, don’t hesitate to contact your insurance agent for clarification. They can help you understand the details of your coverage and ensure you have the right protection for your needs. Remember, your insurance declaration page is your roadmap to understanding your insurance policy, so take the time to decipher it and stay informed.

Remember to review your declaration page annually, especially when you renew your policy. Life changes, such as home renovations, new vehicles, or changes in family circumstances, can impact your insurance needs. By reviewing your declaration page and discussing your needs with your insurance agent, you can ensure your coverage remains adequate and up-to-date. Proactive management of your insurance policy is key to protecting yourself and your assets.

Furthermore, comparing your declaration page with your actual policy document can be beneficial. While the declaration page provides a summary, the full policy document contains the complete terms and conditions of your insurance agreement. Reading both documents will give you a comprehensive understanding of your coverage.

Finally, don’t be afraid to ask questions. Insurance can be complex, and your insurance agent is there to help you understand your policy. If you’re unsure about anything on your declaration page, or if you have any questions about your coverage, contact your agent for clarification. They can explain the details of your policy in plain language and help you make informed decisions about your insurance needs.

Frequently Asked Questions (FAQs)

1. What is the difference between a declaration page and an insurance policy?

The declaration page is a summary of your insurance policy, providing key information like coverage limits, deductibles, and the insured property. The full insurance policy is a comprehensive document containing all the terms and conditions of your coverage. The declaration page is a quick reference guide, while the policy is the complete legal agreement.

2. How often should I review my insurance declaration page?

You should review your declaration page at least annually, especially when you renew your policy. You should also review it whenever you experience a significant life change, such as home renovations, purchasing a new vehicle, or changes in your family circumstances.

3. What should I do if I find an error on my insurance declaration page?

If you find an error on your declaration page, such as an incorrect address or VIN, contact your insurance agent immediately to have it corrected. Errors on your declaration page could potentially jeopardize your coverage.

4. Can I change my coverage limits or deductibles after my policy has started?

Yes, you can typically change your coverage limits or deductibles after your policy has started. Contact your insurance agent to discuss your options and the potential impact on your premiums.

5. Where can I find my insurance declaration page?

Your insurance declaration page is typically sent to you when you first purchase your policy and upon each renewal. You may also be able to access it online through your insurance company’s website or mobile app. If you can’t find your declaration page, contact your insurance agent or company for a copy.

Translation to English (Already in English – this is the original text)

The provided article is already written in English, so no translation is required. The text above represents the final product in the requested language.

Related Article

- Navigating The Complexities Of 701 Insurance: A Comprehensive Guide

- Insurance 25/50/25

- Navigating The Affordable Care Act: A Comprehensive Guide To Insurance Coverage

- Navigating The Labyrinth: A Comprehensive Guide To Insurance License Renewal

- Navigating The Complex World Of Insurance: A Comprehensive Guide To Insurance24 And Beyond

Thus, we hope this article has provided valuable insight into Decoding Your Insurance Declaration Page: A Comprehensive Guide. We thank you for your attention to our article. See you in our next article!